How to trade CFD: 4 steps to start

Contracts for Difference (CFD) trading is a financial instrument that allows you to speculate on the rising or falling prices of fast-moving global financial markets or instruments. Unlike regular trading, CFDs allow you to speculate on a price movement without actually owning the underlying asset. To succeed in this, you need a solid understanding of the fundamental and advanced trading concepts. In this article, you’ll learn four steps you need to take to start your trading journey smoothly.

1. Learn the Trading Platform

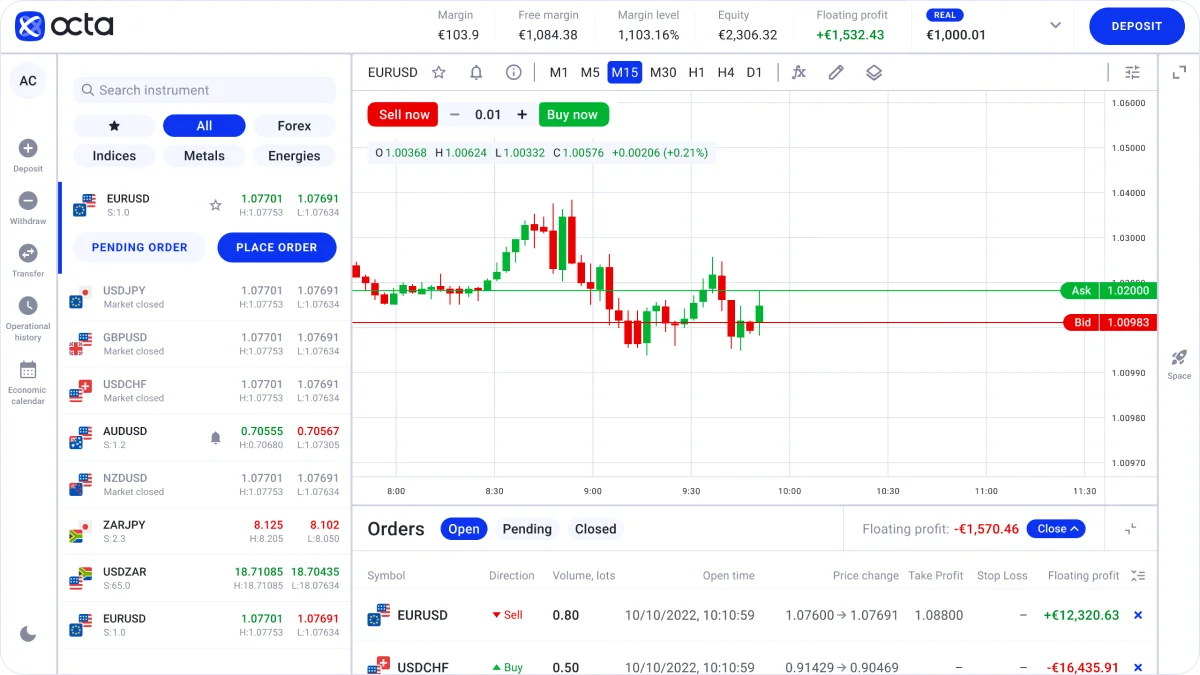

When you begin your journey into CFD trading, the first step is crucial: choosing and understanding your trading platform. The platform serves as your gateway to the financial markets and a tool where all your trading transactions will take place.

Our ActuallyTrader platform is accessible as a Web terminal and Android App, and it saves your settings and strategies on each device without the need to duplicate them by hand. Here, you can dive into trading smoothly and develop your trading style using various instruments. Start with the basics: familiarize yourself with navigating the interface. Locate where market quotes are displayed, learn how to access different chart time frames, and find the order execution buttons.

Practice opening and closing trades in a demo environment. It will help you to grasp trade execution mechanics without risking real money. Pay close attention to the various order types our platform supports. Alongside basic market orders, ensure you know how to place limit and stop orders, which can be crucial for your trading strategy.

2. Choose a Trading Strategy

Understand your trading personality

The journey to successful CFD trading begins with a thorough self-assessment to understand your psychological type. Are you a risk-taker, or do you prefer to keep it safer?Do you thrive in fast-paced environments or perform better with well-thought-out plans over longer periods? This introspective step is crucial as it aligns your trading activities with your comfort zone, ensuring you are not operating under undue stress or against your natural inclinations.

Define trading goals

Clear trading goals set the direction for your trading journey. For example, day trading could suit those looking for quick, short-term gains. Long-term or swing trading is better suited if you aim for larger profits over extended periods. Always remember that CFD trading involves potential risks, and you may lose the invested amount while trading. Understanding your financial goals will help you determine the intensity and duration of your trades.

Explore trading strategies

Once you have a clear understanding of your personality, experience, and goals, it's time to delve into the different trading strategies available:

- Day Trading: This strategy involves entering and exiting trades within the same trading day. It requires you to dedicate much of your day to monitoring the markets and making quick decisions.

- Scalping: This is one of the fastest trading strategies, involving making numerous small speculations on minor price changes throughout the day. Scalpers need to have a high tolerance for risk and the ability to react swiftly to market changes.

- Swing Trading: This strategy involves holding positions for several days to capitalise on expected directional moves in the markets. It's suitable if you can't monitor the markets every minute but can dedicate a few hours daily for analysis.

- Long-term Trading: Also known as position trading, this strategy involves holding positions for weeks, months, or even years. It can fit you if you prefer analysing fundamental factors affecting markets and are comfortable with waiting for significant price movements.

Adapt to trading situations and utilise patterns

Being adaptable and having a clear understanding of how different situations impact the market can significantly enhance your trading effectiveness.

For example, a bullish market might call for strategies that capitalise on rising prices, while a bearish market demands strategies suitable for declining prices.

Patterns like head and shoulders, flags, wedges, and triangles can provide insights into market sentiment and potential price movements.

Developing the skill to identify these patterns and understanding their implications can help in making more informed trading decisions and could be incorporated into your strategy for better prediction and execution of trades.

Implement risk management

Risk management involves identifying, assessing, and prioritising risks and applying resources to minimise, control,

and monitor the impact of unfortunate events. Effective risk management techniques include:

- Setting stop-loss orders to limit potential losses.

- Sizing positions appropriately to avoid overexposure.

- Diversifying your portfolio to spread risk.

The goal is to preserve capital and ensure longevity in the trading business.

3. Select an Asset

Each asset class—currency pairs, stocks, indices and commodities—has distinct characteristics and factors influencing their market movements. Understanding these can help align your asset choice with your trading strategy and goals.

- Currency Pairs: Forex trading involves pairs of currencies traded against each other. They are known for their liquidity and can be less volatile than other asset classes. However, major economic announcements can lead to significant price fluctuations.

- Stocks: Individual company stocks are popular for traders looking to leverage market news and company performance. While potentially more volatile than currencies, they offer the opportunity for substantial returns, especially when trading on earnings reports or market trends.

- Indices: Trading indices allow you to speculate on the overall movement of an entire stock market, such as the S&P 500 or the Dow Jones. They are less volatile than individual stocks and provide a broader market exposure, making them suitable for traders looking for diversified risk.

- Commodities: This class includes physical goods like gold, oil, and agricultural products. Commodities can be highly volatile, influenced by geopolitical events, seasonal cycles, and changes in supply and demand. They are suitable for traders who can analyze these factors and have a higher risk tolerance.

Your trading style and goals should significantly influence your asset selection. For example, if you prefer short-term trades, highly liquid and volatile assets like certain currency pairs or stocks might be more suitable. Conversely, if you are a long-term trader, you might opt for assets with more stable trends, like specific indices or commodities.

4. Execute a Trade

Pre-trade preparation

Before initiating any trade, it's essential to establish your risk parameters. For starters, set precise stop-loss and take-profit levels to manage potential risks effectively and secure profits.

A stop-loss order acts as a safety net, limiting your losses if the market moves against you, while a take-profit order locks in your profits at a predetermined level. Nevertheless, be aware of high volatility, which may result in your stop-loss and take-profit levels closing at a price available immediately after your predominated level.

Calculate position size

The calculation of the appropriate position size should be based on your overall capital and individual trade risk, conforming to your comprehensive risk management strategy.

To reduce your exposure and limit the potential losses, you may choose to invest a small percentage of your capital at a time as well as avoid having too many trades at once. The position size should reflect your risk tolerance and the specific market conditions of your trading asset.

Follow your trading plan

After executing your trade, the job isn't over. Active trade management involves monitoring your open positions and responding to market changes. Stay informed about market news and events that could impact your trades. Be prepared to adjust your stop-loss and take-profit orders as needed to adapt to new market information or changes in market sentiment.

Post-trade evaluation

After closing a trade:

- Take the time to review and analyze the outcome.

-

Reflect on what worked well and what could be improved. This evaluation should cover your trade execution,

adherence to your trading plan, and effectiveness of your risk management strategy. - Use this feedback to refine your trading approach, enhance your strategies, and improve future trade execution.

Conclusion

CFD trading requires knowledge, skills, and discipline. Start by learning the platform, choose a strategy that fits your goals and psychological type, select the right asset, and make informed trades. Remember about risk management and market analysis. Success in CFD trading depends on your approach and continuous self-improvement.